Big Changes To The Child And Dependent Care Tax Credits Fsas In 2021 Milestone Financial Planning

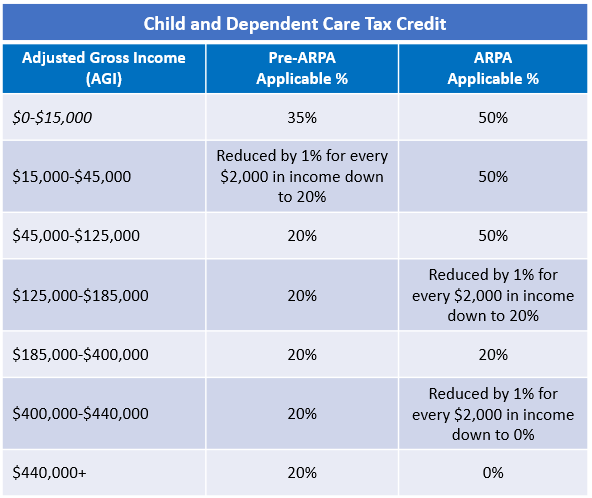

Congressional negotiators announced a roughly 80 billion deal on Tuesday to expand the federal child tax credit that if it becomes law would. Whether youre raising kids planning for retirement or investing in education understanding the tax credits available in 2023 can significantly. Increased to 9000 from 6000 thanks to the American Rescue Plan 3000 for each child over age 6. The Child Tax Credit begins to be reduced to 2000 per child if your modified AGI in 2021 exceeds 150000 if married and filing a joint return or if. The percentage and the child care expense thresholds changed so you can get a credit up to 50 of 8000 4000 in child care expenses..

The child tax credit may expand in 2024 Heres what it means for you The changes agreed to by negotiators would primarily benefit lower-income families with multiple children. WASHINGTON The Internal Revenue Service today announced Monday Jan 29 2024 as the official start date of the nations 2024 tax season when the agency will begin. Ron Wyden D Ore and Rep Jason Smith R Mo said the plan includes a phased increase to the refundable portion of the child tax credit CTC for 2023 2024 and 2025 and. Also the IRS cannot issue refunds for people claiming the Earned Income Tax Credit EITC or Additional Child Tax Credit ACTC before mid-February The law requires the IRS to. For tax year 2023 you can claim the child tax credit and the additional child tax credit on the federal tax return Form 1040 or 1040-SR that you file by April 15 2024 or by..

You qualify for the full amount of the 2023 Child Tax Credit for each qualifying child if you meet all eligibility factors and your annual income is not more than 200000 400000 if. The child tax credit is a tax benefit for people with qualifying children For the 2023 tax year taxpayers may be eligible for a credit of up to 2000 and 1600 of that may be. The maximum tax credit per qualifying child is 2000 for children under 17 For the refundable portion of the credit or the additional child tax credit you may receive up to. January 16 2024 659 PM EST CBS News The federal Child Tax Credit may soon get an expansion as part of a push from some lawmakers to ensure that more US..

You qualify for the full amount of the 2023 Child Tax Credit for each qualifying child if you meet all eligibility factors and your annual income is not more than 200000 400000 if. Frequently asked questions about 2021 Child Tax Credit and Advance Child Tax Credit Payments Verifying Your Identity to view your Online Account. You can use your username and password for the Child Tax Credit Update Portal to sign in to your online account The Child Tax Credit Update Portal is no longer available. Get your advance payments total and number of qualifying children in your online account You can use your username and password for the Child Tax Credit. Among other things it provides direct links to the Non-Filer Sign Up Tool the Child Tax Credit Update Portal the Child Tax Credit..

How Much Could You Receive From The Cdctc In 2023 Bipartisan Policy Center

Comments